Chequing

- Save

- Spend

- Invest

- Borrow

- Learn

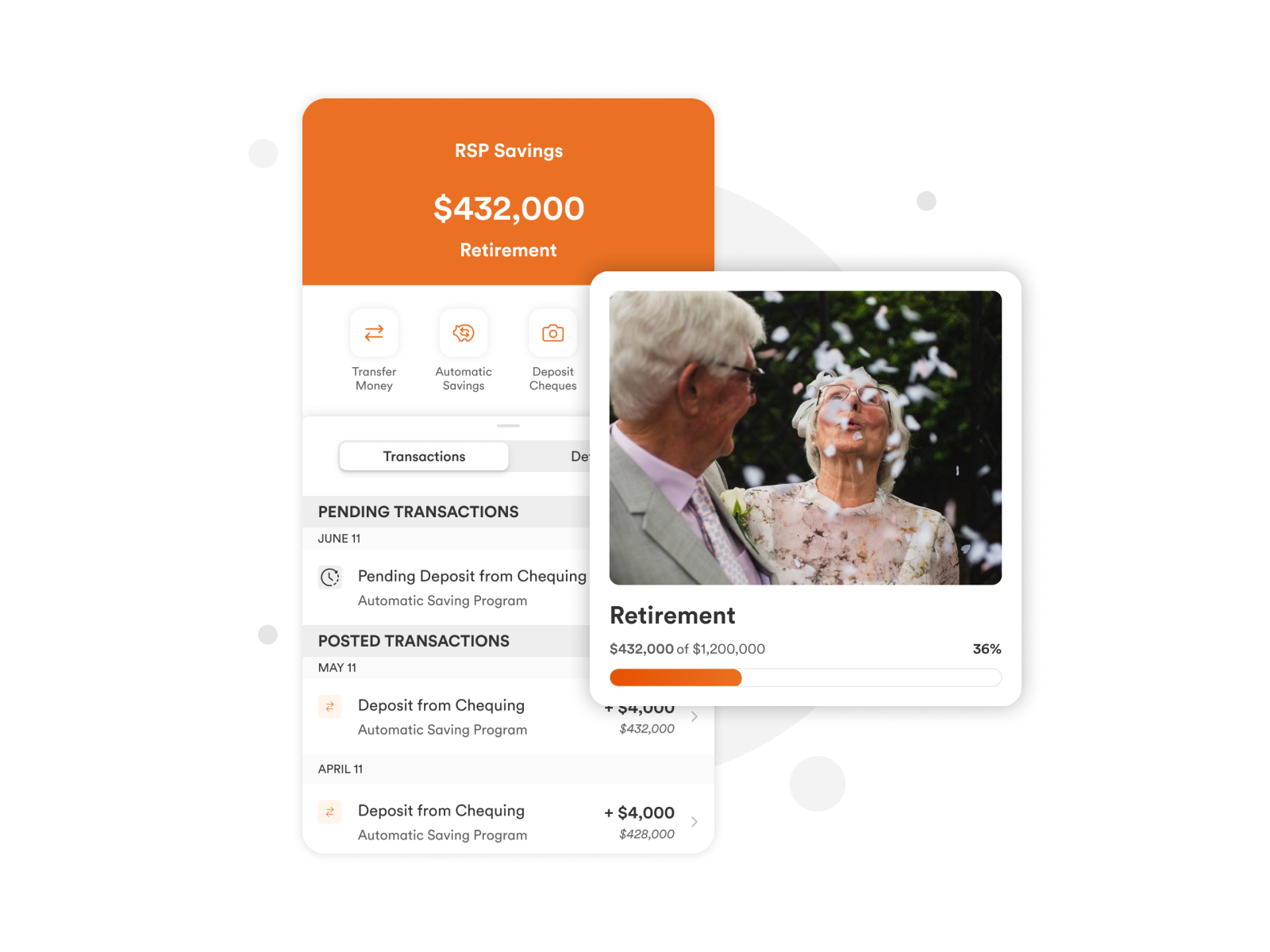

Save for your retirement by earning interest while enjoying no minimums and no unfair^ fees.

[[SAVINGS_RSP.RATE]]†

Interest rate

$0

Monthly fee

$0

Minimum balance

Grow your retirement savings with an interest rate of [[SAVINGS_RSP.RATE]]† since [[SAVINGS_RSP.DATE]].

Easily move your money to other investment choices within your RSPRSP at any time. You’re never locked in.

We simply don’t believe in unfair fees. Why should you have to pay money to save for retirement?

Contributions to an RSP can be deducted from your taxable income, which is especially worthwhile if you use this tax saved to make a contribution for next year or to pay off debts.

The money you contribute, up to your contribution limit, and the earnings you make on your investments are only subject to tax when you withdraw from your RSP.

Spousal RSP contributions help ensure future retirement income is split evenly between you and your partner.

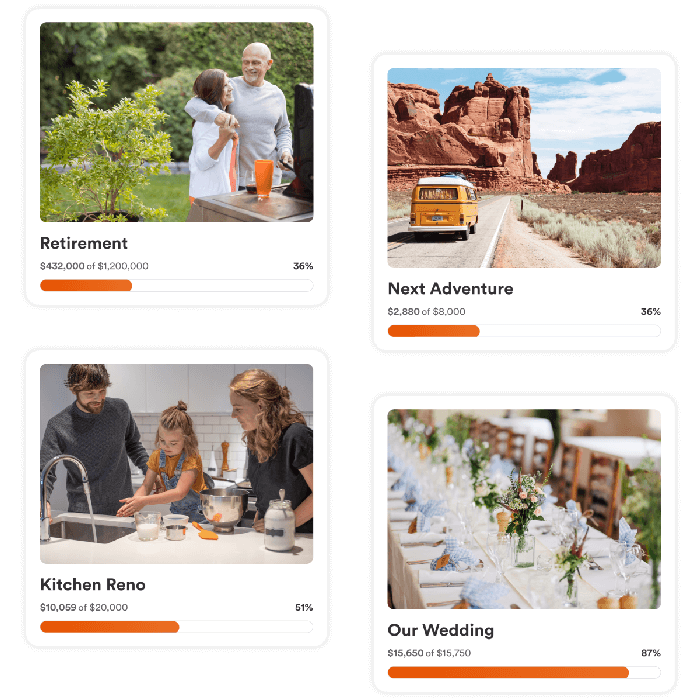

Create a personalized savings goal and have money moved automatically to your Tangerine Account.

Keeping your banking info safe isn’t the only thing required to keep your Accounts protected. Discover expert tips and 24/7 security features for peace of mind all year long.

Enjoy tax-deferred growth while investing for your retirement.

Protect your retirement savings with the guaranteed growth of a GIC combined with the tax benefits of an RSP.

2 The Tangerine New Client 5.50% Interest Rate Offer (the "Offer") is available to new Tangerine Clients who: (a) have a Client Number created between November 6, 2024 and March 31, 2025, and (b) open an Eligible Savings Account as the Primary Account Holder within 60 days of the date their Client Number was created. The 5.50% Promotional Rate will apply to deposits made to an eligible Client’s Eligible Savings Account(s) for 153 days (5 months) beginning on the date all Qualifying Conditions have been met, to a maximum of $1,000,000 (in the currency of the Eligible Savings Account) per Eligible Savings Account Type (for deposits to registered Eligible Savings Accounts made through a T2033 form, please see the full Offer Terms and Conditions). The Promotional Rate is an annualized rate, calculated daily and paid monthly. All deposits to TFSAs and RSP Savings Accounts are subject to the limits imposed by the Canada Revenue Agency (CRA) and the Client is fully responsible for ensuring any and all deposits fall within these set CRA limits.

The Offer is only applicable to Accounts where the eligible new Client is the Primary Account Holder. Offer can’t be combined with any other promotional Savings rate offers except as otherwise permitted. By accepting any Offer, you agree to the terms and conditions of this Offer. Full Offer Terms and Conditions, including definitions of any capitalized terms, are available here. Offer may be changed, extended or cancelled without notice.

^Fair fees mean they are disclosed and agreed to in advance, and the amount makes sense relative to the benefit received. Registered Accounts have no unfair fees while your funds are with us. If at some point you decide to transfer your funds to another financial institution, a fee will apply. View the complete list of Account fees.

† Savings Account, Chequing Account, and GIC interest rates expressed on this website are annual interest rates and are current as of today's date. Interest rates are subject to change without notice. Interest is calculated daily and paid monthly on our Savings and Chequing Accounts. GIC terms of one year or longer have interest calculated on the basis of 365/366 days and compounded and/or paid annually. GIC terms of less than one year have interest calculated on the basis of 365/366 and paid at maturity.