Chequing

Woo-hoo! You’re in

Congrats on landing your new Money-Back Credit Card. There’s a lot to look forward to. But first, let’s get you set up with a few things you should know.

Your Card’s on its way:

Now that you’ve been officially approved, you’ll need an actual Card. And you can expect yours to arrive in about 10 business days.

Steps for activating your new Card:

Step 1

Log in and choose your Money-Back Credit Card Account under ‘Spending’.

Step 2

For desktop, hit ‘Activate’. For mobile, go to ‘More Actions’ and then hit ‘Activate’.

Step 3

Enter your CVC (the three digits on the back of your card) and your PIN, then hit the ‘Activate’ button.

Spend smart and confidently

No matter what device, we’ve got you covered. Add your Tangerine Client Card and Credit Card to your mobile wallet and use it where contactless payments are accepted.

Add an authorized user

It's easy to add an Authorized User to your Account. Once you’re logged in, click your Credit Card Account and go to ‘Account Details’. Click ‘Manage’ under ‘Authorized Users’.

Remember, as the Primary Cardholder, you’re responsible for paying for the entire balance on your Credit Card Account, including any charges made by Authorized Users.

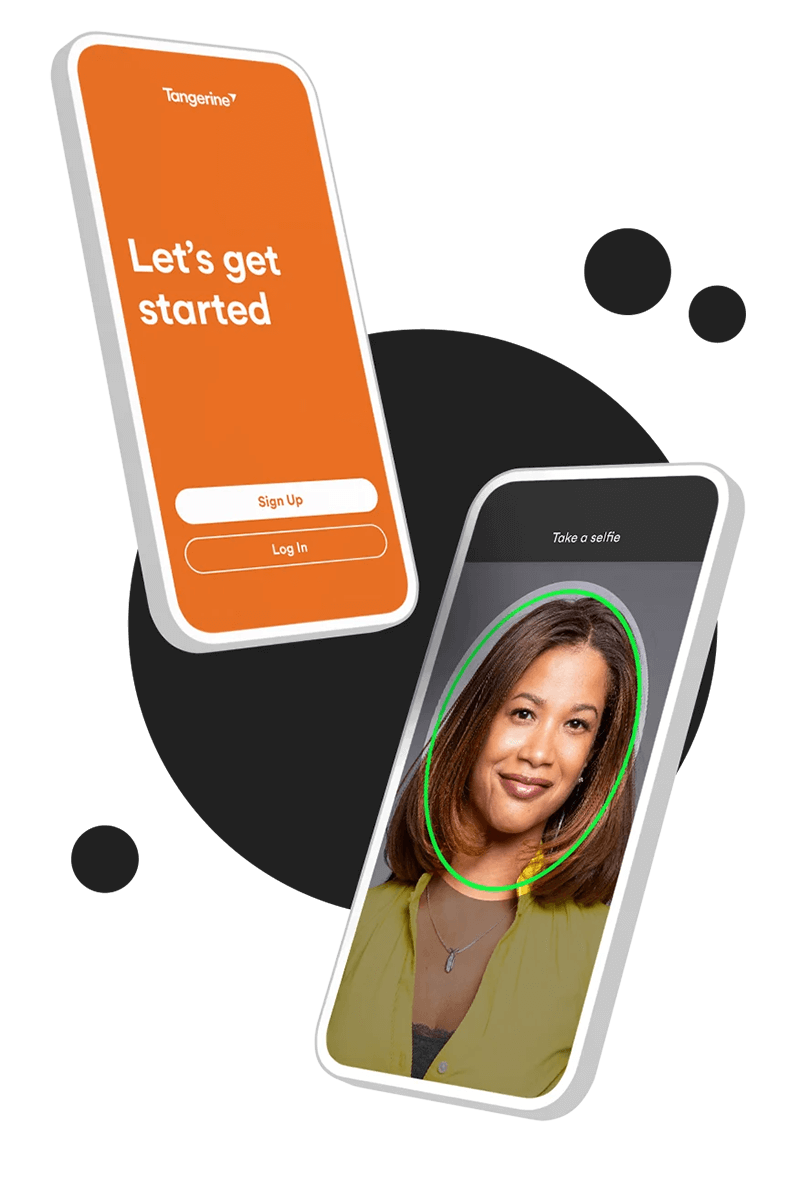

Download the app

Don’t have our Mobile Banking app3 yet? Download it today, so you can bank easily from anywhere.

Don’t forget to take advantage of these great card features!

Unlimited money back and no annual fee

Earn cash back

Earn 2% Money-Back Rewards in up to 3 Categories of your choice, and 0.50% Money-Back Rewards on all your everyday purchases.

Earn extra Rewards

Get your Rewards deposited into your Tangerine Savings Account and get a third 2% Money-Back Category.

Earn automatically

Money-Back Rewards are unlimited and automatically paid monthly.

Additional Card features⁵

Travel Notices

Share your international travel plans with us in advance. This helps us know that your Credit Card transactions outside of Canada are legitimate.

Easy online Pause My Card feature – in case you need it

If you ever think you’ve lost or misplaced your Card, there’s no need to panic. With a couple quick clicks, you can temporarily suspend it.

Mastercard Tap & GoTM

Mastercard Zero Liability†

Mastercard® accepted worldwide at more than 24 million locations in over 210 countries

Check out these helpful articles

General Terms:

Applicants must apply for the Card and must consent to a credit check. Accounts must be in Good Standing in order to receive Money-Back Rewards. See the Tangerine Money-Back Rewards Program Terms & Conditions for full details.

Balance Transfers are treated as Cash Advances and interest applies from the transaction date that appears on your monthly statement to the date you repay the balance in full. There is no interest-free grace period on Cash Advances or Balance Transfers.

Annual Interest Rates: The annual interest rate on Purchases is 20.95% and Cash Advances (including Balance Transfers) is 22.95%. Rates are subject to change. If you don't make 2 consecutive monthly Minimum Payments, or at any time thereafter, an interest rate of 25.95% will apply to your Account on Purchases and 27.95% on Cash Advances (including Balance Transfers).

Other Fees and Rates: These fees are charged on the day the transaction occurs (unless otherwise indicated): Cash Advance: $3.50 within Canada, $5 outside of Canada; Balance Transfer: 3% or minimum of $5 (unless reduced or waived) of the amount transferred when it is posted to your Account. Dishonoured Payment: $25; Rush Card: $25; Over-Limit: $25 (maximum one Over-Limit charge per monthly statement period); Past Statement Reprint: $5 per past statement. There is no charge for a reprint of your current monthly statement. Foreign Currency Conversion: When the converted transaction amount gets posted to your Account, we'll add a foreign currency conversion fee of 2.50% to the converted transaction amount.

See your Information Box in the application for full details or visit Tangerine.ca/CreditCardLegal. Rates and fees are subject to change.

Cash Advances (including Balance Transfers) do not earn Tangerine Money-Back Rewards. See the terms and conditions of the Tangerine Money-Back Rewards Program at Tangerine.ca/CreditCardLegal for full details on other items that do not earn Tangerine Money-Back Rewards.

5 Purchase Assurance and Extended Warranty: For most new purchases made anywhere in the world using your Tangerine World Mastercard®, you may receive a lifetime maximum of up to $60,000 for the following insurance coverage:

- Purchase Assurance to automatically cover loss, theft or damage on most new insured items for 90 days from the date of purchase

- Extended Warranty which may double the period of repair services to a maximum of one year

Insurance coverage is underwritten by American Bankers Insurance Company of Florida (ABIC). ABIC, its subsidiaries, and affiliates carry on business in Canada under the name of Assurant®. ®Assurant is a registered trademark of Assurant, Inc. Coverage is subject to eligibility, limitations and exclusions. For details of the coverage, including definitions and benefits, refer to the Certificate of Insurance provided with the card.

Any of these offers may be changed or cancelled at any time without notice.

3 Some conditions may apply. Service is subject to availability and successful digital verification.

4 As of March 2025 from the Google Play Store and App Store.

® App Store is a registered trademark of Apple Inc., registered in the U.S. and other countries.

™ Google Play is a trademark of Google LLC.