Chequing

Business US Dollar Savings Account

Typical business accounts pay little or no interest, but a Tangerine Business US$ Savings Account is designed to complement your existing US dollar business chequing account at another financial institution and help you grow US funds you’d like to set aside for your business savings goals.

[[SAVINGS_BIS_USD.RATE]]†

Interest Rate

$0

Monthly fee

$0

Minimum balance

Great rate

Our rates are great at [[SAVINGS_BIS_USD.RATE]]† since [[SAVINGS_BIS_USD.DATE]]

No unfair^ fees or service charges

We simply don’t believe in unfair fees. So you won’t have to pay to save with us.

No minimum balances

Earn the same great rate on every dollar in your Account.

Steps to open a Business US$ Savings Account

US$ business chequing account with another financial institution

You’ll need a US$ business chequing account at another financial institution in order for your US dollars to be accessible. We want to make sure you realize that this is a Savings Account to grow your business savings, not a chequing account which is used for the day to day operation of your business.

Personal Client Number with Tangerine

To open a Business US$ Savings Account, you first need to have a personal Client Number with Tangerine. Once you're done signing up as a personal Client, you can open an Account for your business.

Call us

If you already have a Tangerine Business US$ Savings Account, call us at 1-888-826-4374 to open a subsequent US$ Savings Account for the same business.

Check out these helpful articles

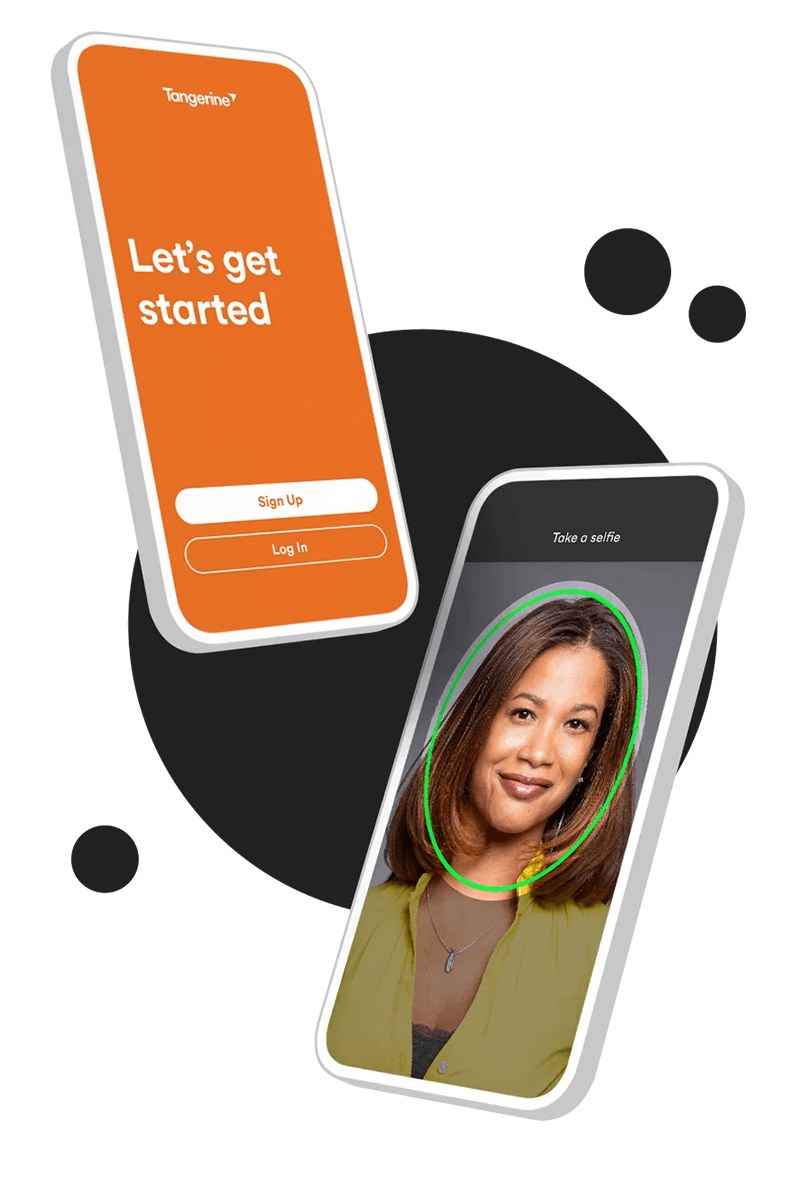

Join with our app

Become a Client completely digitally with our Mobile Banking app3. Sign up without leaving your home or having to call us—it’s a fast, convenient and secure mobile experience.

Don’t have our Mobile Banking app3 yet? Download it today, so you can bank easily from anywhere.

Take a look at our other products

Business Savings Account

Grow your business cash at a great interest rate. With no fees or service charges, all of our Savings options for business Clients are designed to help you reach your business goals faster.

Business Guaranteed Investment (GIC)

For funds that won't be needed for a while, a Tangerine Business GIC is a perfect way to earn a great interest rate without fees or service charges.

^Fair fees mean they are disclosed and agreed to in advance, and the amount makes sense relative to the benefit received. For more details about any of our fees, please see our fee schedule here.

†Business Savings Account and Business GIC interest rates expressed on this website are annual interest rates and are current as of today's date. Interest rates are subject to change without notice. Interest is calculated daily and paid monthly on our Savings Accounts. GIC terms of one year or longer have interest calculated on the basis of 365/366 days and compounded and/or paid annually. GIC terms of less than one year have interest calculated on the basis of 365/366 and paid at maturity. In order for us to properly confirm all of the required details for the business, business Clients must have a Canadian dollar Business Savings Account as their first Tangerine Business Account. Subsequent Account types can then be opened with us over the phone.

3 Some conditions may apply. Service is subject to availability and successful digital verification.

4 As of March 2025 from the Google Play Store and App Store.

® App Store is a registered trademark of Apple Inc., registered in the U.S. and other countries.

™ Google Play is a trademark of Google LLC.