Chequing

Money Market Fund

Our Money Market Fund is a stable, low-fee1 solution that aims to protect the value of your Investment even through volatile times in the market.

Key features

Capital preservation

Feel confident in any market with a conservative approach.

Liquidity

Invests in short-term investments so you can access your money easily.

Fixed income

Designed for investors who value stable income with investments in fixed income, cash, and cash equivalents.

We’ll gather some info from you to help make sure this Fund is a good fit for you.

Overview

This Fund invests 100% in fixed income, cash, and cash equivalents and is designed to be a low risk option while aiming for more modest returns for risk averse investors.

This Fund may be right for you if you’re:

| Term | Annualized returns as of [[REPORT.DATE]] net of fees |

|---|---|

| 1 year | 4.09% |

| 3 years | - |

| 5 years | - |

| 10 years | - |

| Inception | 3.95% |

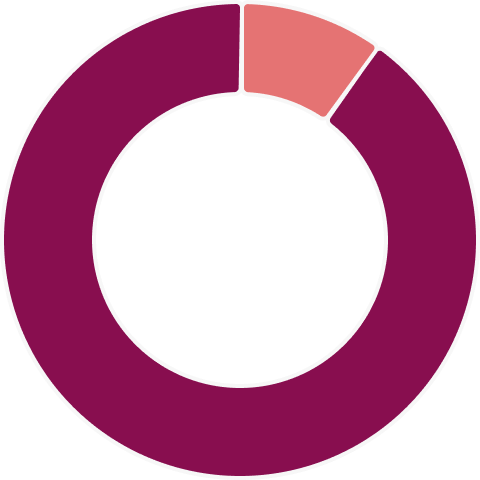

Allocation & holdings

| Fixed Income | |

|---|---|

| Dynamic Money Market Fund Series O | 92.4% |

| Cash and Cash Equivalents | |

| Cash and other Net Assets (Liabilities) | 7.6% |

Informational only: This is how we aim to manage your Portfolio. The percentages may change slightly over time.

92.4%

Fixed Income

7.6%

Cash & Cash

Equivalent

Low

Risk

Here’s the nitty-gritty stuff

- Details

- Fund Documents

| Unit Price as of [[BAL_INC.NAV.DAY.DATE]] | [[MMF.NAV.DAY.VALUE]] |

| Fund Code | INI500 |

| Inception Date | January 25, 2024 |

| Total value of the Fund (millions) | $41.79 (as of [[REPORT.DATE]]) |

| Distributions | Monthly |

| Management Expense Ratio (MER)1 | 0.77% |

Want to speak to an Investment Funds Advisor?

Our licenced Advisors are here for you if you need them. Speak with us at 1-877-464-5678. Monday to Friday, 8 am – 8 pm ET.

Take a look at our other Investment options

Core Portfolios

Tried, tested and true, these are our original Portfolios. They come with our history of helping Canadians reach their financial goals.

Global ETF Portfolios

A simple low-cost* way to have exposure to a selection of Exchange Traded Funds (ETFs) in a mutual fund.

Socially Responsible Global Portfolios

Socially Responsible investing, or SRI, is a strategy that considers not only the financial returns from an investment, but also its impact on environmental, ethical and social issues.