Chequing

Tangerine World Mastercard®

- Unlimited 2% cash back in 2 categories of your choice + 0.5% back on everything else

- Up to 2% Money-Back Rewards deposited into your Account monthly

- Mobile device insurance and more

$0

Annual fee

20.95%

Purchase Interest Rate

22.95%

Cash Advance Interest Rate

Special Offer

Earn 10% cash back10 for 2 months (Up to $100)

That’s on top of regular cash back. Plus, get a promo rate on balances you transfer for a limited time. Learn More

No annual fee

It’s another way to help you save while you’re spending.

Unlimited 2% cash back in 2 categories of your choice + 0.5% back on everything else

Easily customize categories to suit your needs and automatically receive your Money-Back Rewards every month.

Uncomplicated Card benefits⁵

- Purchase Assurance and Extended Warranty

- $1,000 of insurance coverage for your mobile device

- Rental Car Collision/Loss Damage Insurance

- Automatic monthly deposits

- Free Cards for up to 5 users - no annual fee for those Cards

Transfer and save

During your first 30 days, transfer balances up to your credit limit and pay an interest rate of only 1.95% on the transferred balance for 6 months (22.95% after that). A Balance Transfer fee of 1% on the amount transferred will apply.11

Set your sights on the season

Change your cash back categories to suit your spending.

2% Money-Back Categories

Get your Rewards deposited into your Tangerine Savings Account and earn more!

Pick two 2% Money-Back Rewards Categories

Choose your categories based on your spending to maximize your savings.

AND

Unlock a third 2% category

…when you have your Rewards deposited automatically into a Tangerine Savings Account.

Choose from:

Grocery

Furniture

Restaurants

Hotel-Motel

Gas

Recurring Bill Payments

Drug Store

Home Improvement

Entertainment

Public Transportation and Parking

Tangerine benefits⁵

Purchase Assurance and Extended Warranty

You may receive a lifetime maximum of up to $60,000.

Mobile Device Insurance

Up to $1,000 of coverage for your mobile device.

Rental Car Collision/

Loss Damage Insurance

Get damage & theft protection for car rentals.

Add up to 5 users on one Account

Add up to 5 people – one Account, multiple Cards, no annual fee for those Cards.

World Mastercard® Benefits⁶

Mastercard® Travel Pass Provided By DragonPass

Exclusive dining, retail and spa offers in over 650 airports worldwide, along with access to over 1,300 airport lounges at $32 USD per visit.

Mastercard® Travel Rewards

While travelling outside Canada, use this Card to unlock cashback offers at participating merchants.

On-Demand and Subscription Services

Enjoy special benefits and offers from on-demand apps & subscription services.

Mobile Wallets

Add your Tangerine Client Card and Credit Card to your Apple Pay, Google Pay, and Samsung Pay mobile wallets and use it where contactless payments are accepted.

Fees & Interest

There is $0 annual fee with the Tangerine World Mastercard®

| Account Fee | $0 |

| Interest Rate on Purchases: | 20.95% |

| Balance transfer fee: | 3% of the amount transferred, or minimum of $5.00 |

| Promotional Balance transfer interest rate11 | 1.95% interest for the first 6 months (22.95% after that) |

| Foreign currency conversion | 2.50% |

| Cash advance | $3.50 within Canada, $5.00 outside Canada |

| Interest on Cash Advances | 22.95% |

| Dishonoured payment | $25.00 |

| Over-Limit | $25.00 |

| Rush Card | $25.00 |

| Past statement reprint | $5.00 per statement, no charge for reprint of current monthly statement |

Grace Period: We calculate interest on any amount owed from the transaction date until that amount has been paid in full. However, we don’t charge interest on new purchases that appear on your Credit Card Account statement for the first time if we receive payment in full of your balance (as shown on your Credit Card Account statement) by the Payment Due Date on that statement. This interest-free grace period doesn’t apply to Cash Advances.

See the Disclosure Statement that you will receive with your Card for full details about the fees and rates that apply to your Card.

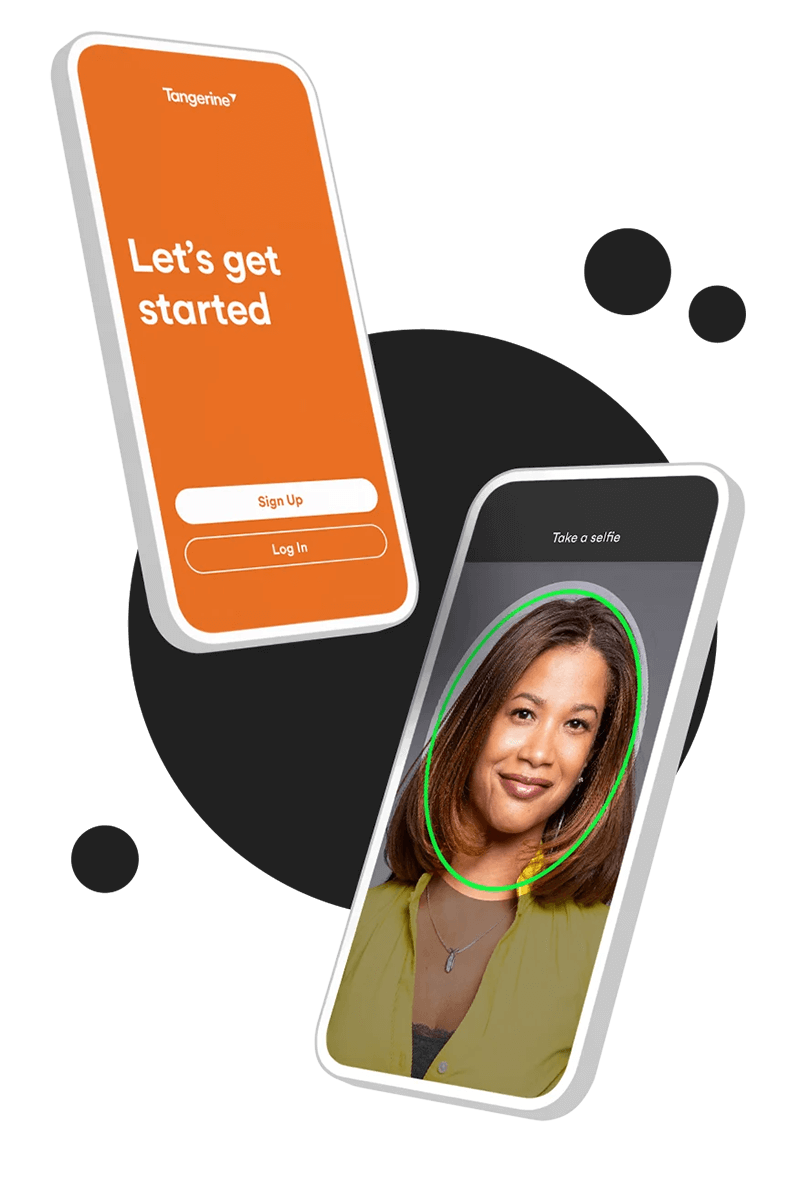

Join with our app

Become a Client completely digitally with our Mobile Banking app3. Sign up without leaving your home or having to call us—it’s a fast, convenient and secure mobile experience.

Don’t have our Mobile Banking app3 yet? Download it today, so you can bank easily from anywhere.

Check out these helpful articles

Take a look at our other products

Tangerine Line of Credit

Money that's always there to borrow when you need it, with the flexibility to repay and reuse at your own pace.

No-Fee Daily Chequing Account

No fees for daily chequing transactions, no minimum balance requirements, and earn interest.