Three different types of insurance for homeowners

Your home is likely your most valuable asset, so it's only natural that you'll want to protect it. There are three types of insurance every homeowner should be aware of: home insurance, mortgage insurance and mortgage life insurance. It's important to understand each type to make sure your home and loved ones are properly protected if disaster ever strikes.

Home insurance

If you're looking to protect your home and its contents, look no further than home insurance. Most lenders require that you have home insurance in place by your closing date, otherwise your mortgage won't be approved. There are three main types of home insurance: basic, broad and comprehensive. You can also buy extra coverage (known as “riders") for sewer backup and expensive items like jewelry.

Basic is your “no frills" insurance policy. It's the least costly, but it also offers the bare minimum in protection. You're only covered for “named perils" like fire, theft and wind. Broad is a mid-range policy that costs more than basic, but offers a higher level of protection. Broad policies protect your home and its contents from “named perils" similar to basic, plus some extra hazards named in your policy. The third type, comprehensive, gives homeowners the highest level of protection. Most comprehensive policies protect your home from all disasters, except any exclusions in your policy, such as damage caused by flooding and wear and tear.

Mortgage insurance

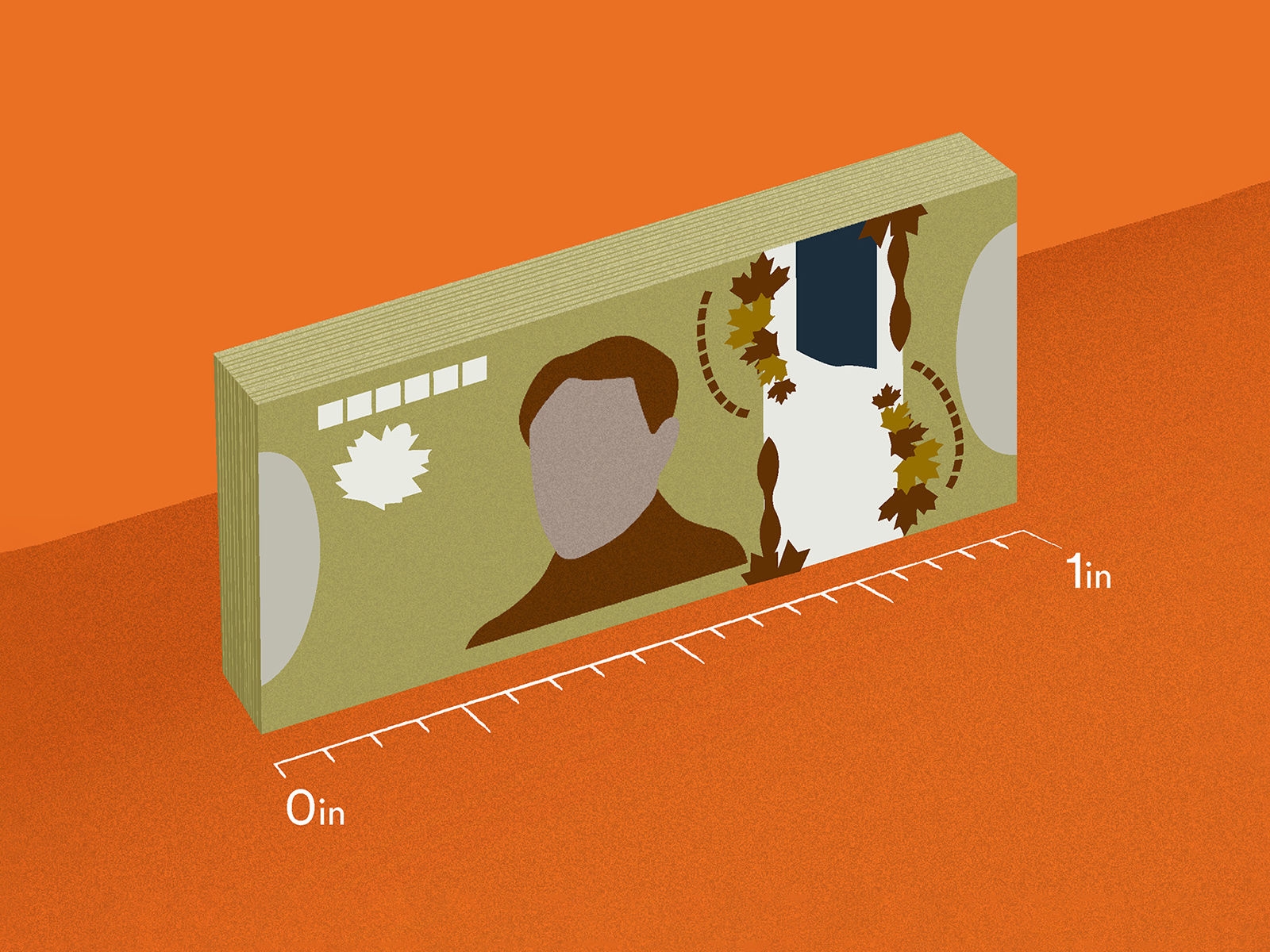

If your down payment is between 5 percent on the purchase price up to $500,000 and 10 percent for the remaining portion of the purchase price up to $999,999, and 19.99 percent, your mortgage is high-ratio and you'll need to buy mortgage insurance. Unlike home insurance, mortgage insurance doesn't protect you – it protects your lender in the event you fail to repay your mortgage. How much you pay in mortgage insurance depends on the size of your down payment. The closer your down payment is to 20 percent, the lower the percentage of mortgage insurance premiums you'll shell out. There are three main providers of mortgage insurance in Canada: Canada Mortgage and Housing CorporationTM (CMHC), Genworth Canada and Canada GuarantyTM.

Unlike other closing costs, mortgage insurance premiums don't have to be paid before your closing date. Most homeowners choose to add it to their total mortgage amount and amortize it over the life of their mortgage. Although this helps when you don't have a 20 percent down payment, it comes at a cost – this can add thousands in interest over the life of your mortgage.

Mortgage life insurance

For most families, a mortgage is the biggest debt of their lifetime. If you were to suddenly pass away, it could leave your family in a financial bind. Mortgage life insurance helps homeowners get a good night's sleep and not worry about who will pay the mortgage. Your mortgage would be fully paid (usually up to a limit) in the event that you pass away. Your premiums stay the same over the life of your mortgage, making it a lot more affordable than most permanent life insurance policies.

Mortgage life insurance isn't without its downsides, since it's a lot less flexible than term insurance. Your beneficiary isn't your spouse or children, it's your bank – the payout can only be used to pay off your mortgage. Before deciding on mortgage life insurance versus term or permanent insurance, weigh your options carefully. Make sure you sign up for some type of insurance. Some homeowners skip mortgage life insurance and never get around to signing up for term or permanent, leaving them without any insurance coverage.

Canada Guaranty is a trademark of Canada Guaranty Mortgage Insurance Company

Canada Mortgage and Housing Corporation is a trademark of Canada Mortgage and Housing Corporation