Chequing

Tangerine Socially Responsible Global Portfolios

Socially Responsible investing, or SRI, is a strategy that considers not only the financial returns from an investment, but also its impact on environmental, ethical and social issues. It’s a different way to feel good about your investments.

Key features

Designed to align with your values

Feel good about your investments, knowing that we’ve removed controversial holdings.

Low management fee

Low management fee1 so we can keep your money working harder for you.

Meet your growth needs

Made up of a selection of ETFs in a mutual fund to meet your growth needs.

We’ll help you choose the right Portfolio

- Balanced Income SRI

- Balanced SRI

- Balanced Growth SRI

- Equity Growth SRI

Overview

With 70% in bonds, this is the least risky Portfolio of the bunch. The other 30% is invested in stocks, which provide growth potential. It’s designed to be a safer bet with more modest returns for the more risk averse.

This Portfolio may be right for you if you’re:

| Term | Annualized returns as of [[REPORT.DATE]] net of fees |

|---|---|

| 1 year | [[BAL_INC_SRI.RATE.1_YEAR]] |

| 3 years | [[BAL_INC_SRI.RATE.3_YEAR]] |

| 5 years | [[BAL_INC_SRI.RATE.5_YEAR]] |

| 10 years | [[BAL_INC_SRI.RATE.10_YEAR]] |

| Inception | [[BAL_INC_SRI.RATE.INCEPTION]] |

Explore historical performance.

Allocation & Holdings

| Bonds | |

|---|---|

| [[BAL_INC_SRI.HOLDINGS.BREAKDOWN.BONDS.1_NAME]] | [[BAL_INC_SRI.HOLDINGS.BREAKDOWN.BONDS.1_VALUE]] |

| Stocks | |

| [[BAL_INC_SRI.HOLDINGS.BREAKDOWN.STOCKS.1_NAME]] | [[BAL_INC_SRI.HOLDINGS.BREAKDOWN.STOCKS.1_VALUE]] |

| [[BAL_INC_SRI.HOLDINGS.BREAKDOWN.STOCKS.2_NAME]] | [[BAL_INC_SRI.HOLDINGS.BREAKDOWN.STOCKS.2_VALUE]] |

| [[BAL_INC_SRI.HOLDINGS.BREAKDOWN.STOCKS.3_NAME]] | [[BAL_INC_SRI.HOLDINGS.BREAKDOWN.STOCKS.3_VALUE]] |

| [[BAL_INC_SRI.HOLDINGS.BREAKDOWN.STOCKS.4_NAME]] | [[BAL_INC_SRI.HOLDINGS.BREAKDOWN.STOCKS.4_VALUE]] |

Informational only: This is how we aim to manage your Portfolio. The percentages may change slightly over time.

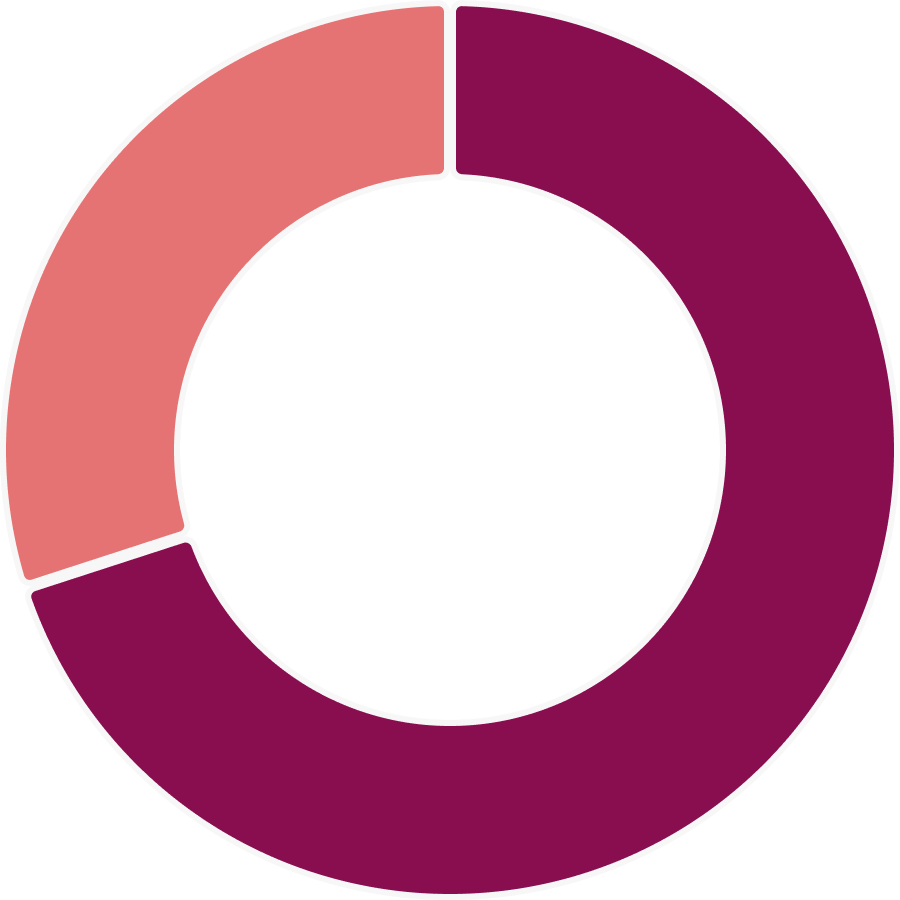

70%

Bonds

30%

Stocks

Low to medium

Risk

Here’s the nitty-gritty stuff

- Details

- Fund Documents

| Unit Price as of [[BAL_INC_SRI.NAV.DAY.DATE]] | [[BAL_INC_SRI.NAV.DAY.VALUE]] |

| Fund Code | INI310 |

| Inception Date | January 14, 2022 |

| Total value of the Fund (millions) | $22.38 (as of [[REPORT.DATE]]) |

| Distributions | Annually, December |

| Management Expense Ratio (MER)1 | [[MER.SRI]] |

Overview

Offers a balance between Exchange Traded Funds (ETFs) that invest in stocks and bonds, increasing your potential for growth while still maintaining stability – and removing investments that don’t align with social and environmental concerns.

This Portfolio may be right for you if you’re:

| Term | Annualized returns as of [[REPORT.DATE]] net of fees |

|---|---|

| 1 year | [[BAL_SRI.RATE.1_YEAR]] |

| 3 years | [[BAL_SRI.RATE.3_YEAR]] |

| 5 years | [[BAL_SRI.RATE.5_YEAR]] |

| 10 years | [[BAL_SRI.RATE.10_YEAR]] |

| Inception | [[BAL_SRI.RATE.INCEPTION]] |

Explore historical performance.

Award-winning fund

Tangerine Investments has scored a FundGrade A+® Award presented by Fundata Canada Inc. for the Balanced SRI Portfolio’s performance in 2024.^

Why it’s a big deal

This yearly award recognizes the ‘best of the best’ among Canadian investment funds that have maintained a high FundGrade rating throughout a calendar year. And only the best performing and consistent Funds can qualify. ^ Now that’s investing done differently.

Allocation & Holdings

| Bonds | |

|---|---|

| [[BAL_SRI.HOLDINGS.BREAKDOWN.BONDS.1_NAME]] | [[BAL_SRI.HOLDINGS.BREAKDOWN.BONDS.1_VALUE]] |

| Stocks | |

| [[BAL_SRI.HOLDINGS.BREAKDOWN.STOCKS.1_NAME]] | [[BAL_SRI.HOLDINGS.BREAKDOWN.STOCKS.1_VALUE]] |

| [[BAL_SRI.HOLDINGS.BREAKDOWN.STOCKS.2_NAME]] | [[BAL_SRI.HOLDINGS.BREAKDOWN.STOCKS.2_VALUE]] |

| [[BAL_SRI.HOLDINGS.BREAKDOWN.STOCKS.3_NAME]] | [[BAL_SRI.HOLDINGS.BREAKDOWN.STOCKS.3_VALUE]] |

| [[BAL_SRI.HOLDINGS.BREAKDOWN.STOCKS.4_NAME]] | [[BAL_SRI.HOLDINGS.BREAKDOWN.STOCKS.4_VALUE]] |

Informational only: This is how we aim to manage your Portfolio. The percentages may change slightly over time.

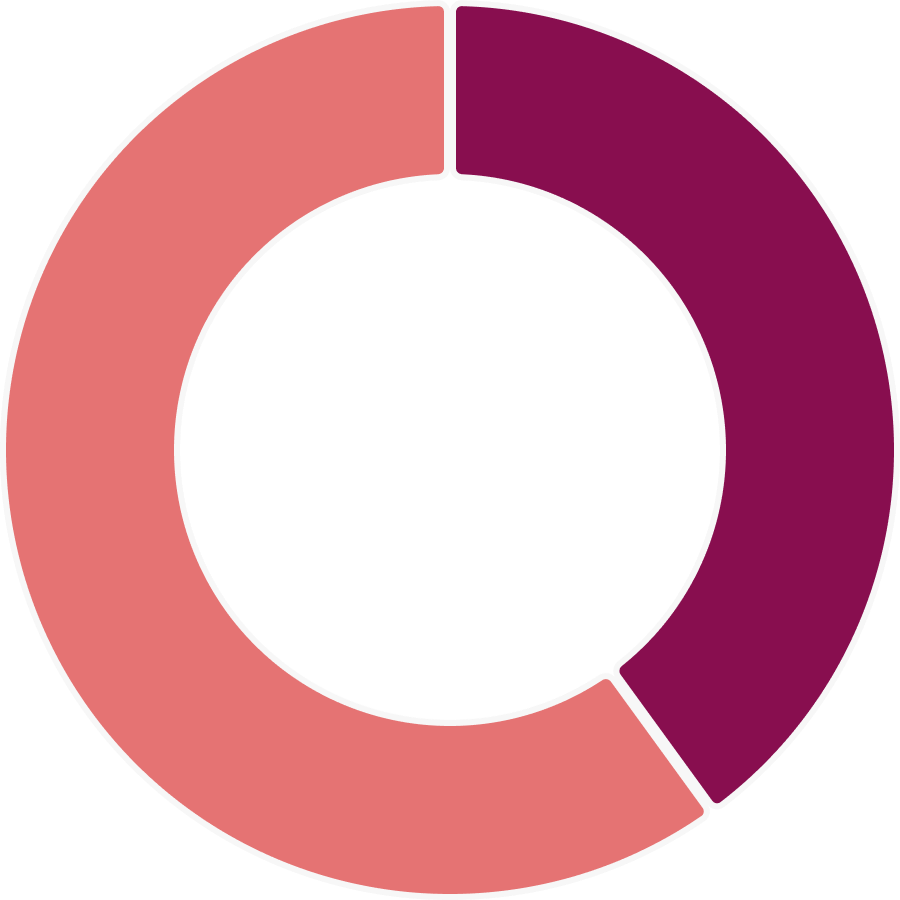

40%

Bonds

60%

Stocks

Low to medium

Risk

Here’s the nitty-gritty stuff

- Details

- Fund Documents

| Unit Price as of [[BAL_SRI.NAV.DAY.DATE]] | [[BAL_SRI.NAV.DAY.VALUE]] |

| Fund Code | INI320 |

| Inception Date | January 14, 2022 |

| Total value of the Fund (millions) | $32.44 (as of [[REPORT.DATE]]) |

| Distributions | Annually, December |

| Management Expense Ratio (MER)1 | [[MER.SRI]] |

Overview

75% of this Portfolio’s investments are in stocks, which provides potential for long-term growth. The remaining 25% in bonds serves to balance out some of the associated risk with a little stability.

This Portfolio may be right for you if you’re:

| Term | Annualized returns as of [[REPORT.DATE]] net of fees |

|---|---|

| 1 year | [[BAL_GROWTH_SRI.RATE.1_YEAR]] |

| 3 years | [[BAL_GROWTH_SRI.RATE.3_YEAR]] |

| 5 years | [[BAL_GROWTH_SRI.RATE.5_YEAR]] |

| 10 years | [[BAL_GROWTH_SRI.RATE.10_YEAR]] |

| Inception | [[BAL_GROWTH_SRI.RATE.INCEPTION]] |

Explore historical performance.

Award-winning fund

Tangerine Investments has scored a FundGrade A+® Award presented by Fundata Canada Inc. for the Balanced Growth SRI Portfolio’s performance in 2024. ^

Why it’s a big deal

This yearly award recognizes the ‘best of the best’ among Canadian investment funds that have maintained a high FundGrade rating throughout a calendar year. And only the best performing and consistent Funds can qualify. ^ Now that’s investing done differently.

Allocation & Holdings

| Bonds | |

|---|---|

| [[BAL_GROWTH_SRI.HOLDINGS.BREAKDOWN.BONDS.1_NAME]] | [[BAL_GROWTH_SRI.HOLDINGS.BREAKDOWN.BONDS.1_VALUE]] |

| Stocks | |

| [[BAL_GROWTH_SRI.HOLDINGS.BREAKDOWN.STOCKS.1_NAME]] | [[BAL_GROWTH_SRI.HOLDINGS.BREAKDOWN.STOCKS.1_VALUE]] |

| [[BAL_GROWTH_SRI.HOLDINGS.BREAKDOWN.STOCKS.2_NAME]] | [[BAL_GROWTH_SRI.HOLDINGS.BREAKDOWN.STOCKS.2_VALUE]] |

| [[BAL_GROWTH_SRI.HOLDINGS.BREAKDOWN.STOCKS.3_NAME]] | [[BAL_GROWTH_SRI.HOLDINGS.BREAKDOWN.STOCKS.3_VALUE]] |

| [[BAL_GROWTH_SRI.HOLDINGS.BREAKDOWN.STOCKS.4_NAME]] | [[BAL_GROWTH_SRI.HOLDINGS.BREAKDOWN.STOCKS.4_VALUE]] |

Informational only: This is how we aim to manage your Portfolio. The percentages may change slightly over time.

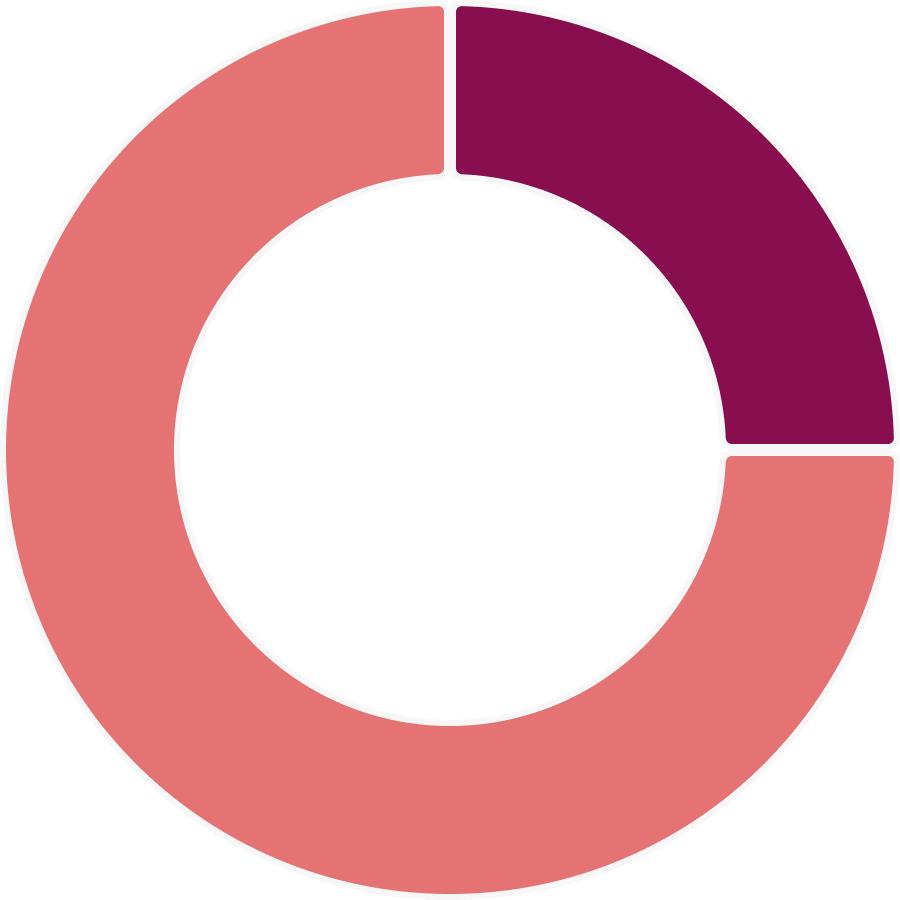

25%

Bonds

75%

Stocks

Medium

Risk

Here’s the nitty-gritty stuff

- Details

- Fund Documents

| Unit Price as of [[BAL_GROWTH_SRI.NAV.DAY.DATE]] | [[BAL_GROWTH_SRI.NAV.DAY.VALUE]] |

| Fund Code | INI330 |

| Inception Date | January 14, 2022 |

| Total value of the Fund (millions) | $122.31 (as of [[REPORT.DATE]]) |

| Distributions | Annually, December |

| Management Expense Ratio (MER)1 | [[MER.SRI]] |

Overview

With no bonds to balance it out during downturns, this Fund can be the riskiest portfolio we offer. However, with that risk comes a potential reward.

This Portfolio may be right for you if you’re:

| Term | Annualized returns as of [[REPORT.DATE]] net of fees |

|---|---|

| 1 year | [[EQ_GROWTH_SRI.RATE.1_YEAR]] |

| 3 years | [[EQ_GROWTH_SRI.RATE.3_YEAR]] |

| 5 years | [[EQ_GROWTH_SRI.RATE.5_YEAR]] |

| 10 years | [[EQ_GROWTH_SRI.RATE.10_YEAR]] |

| Inception | [[EQ_GROWTH_SRI.RATE.INCEPTION]] |

Explore historical performance.

Award-winning fund

Tangerine Investments has scored a FundGrade A+® Award presented by Fundata Canada Inc. for the Equity Growth SRI Portfolio’s performance in 2024. ^

Why it’s a big deal

This yearly award recognizes the ‘best of the best’ among Canadian investment funds that have maintained a high FundGrade rating throughout a calendar year. And only the best performing and consistent Funds can qualify. ^ Now that’s investing done differently.

Allocation & Holdings

| Stocks | |

|---|---|

| [[EQ_GROWTH_SRI.HOLDINGS.BREAKDOWN.STOCKS.1_NAME]] | [[EQ_GROWTH_SRI.HOLDINGS.BREAKDOWN.STOCKS.1_VALUE]] |

| [[EQ_GROWTH_SRI.HOLDINGS.BREAKDOWN.STOCKS.2_NAME]] | [[EQ_GROWTH_SRI.HOLDINGS.BREAKDOWN.STOCKS.2_VALUE]] |

| [[EQ_GROWTH_SRI.HOLDINGS.BREAKDOWN.STOCKS.3_NAME]] | [[EQ_GROWTH_SRI.HOLDINGS.BREAKDOWN.STOCKS.3_VALUE]] |

| [[EQ_GROWTH_SRI.HOLDINGS.BREAKDOWN.STOCKS.4_NAME]] | [[EQ_GROWTH_SRI.HOLDINGS.BREAKDOWN.STOCKS.4_VALUE]] |

Informational only: This is how we aim to manage your Portfolio. The percentages may change slightly over time.

0%

Bonds

100%

Stocks

Medium to high

Risk

Here’s the nitty-gritty stuff

- Details

- Fund Documents

| Unit Price as of [[EQ_GROWTH_SRI.NAV.DAY.DATE]] | [[EQ_GROWTH_SRI.NAV.DAY.VALUE]] |

| Fund Code | INI340 |

| Inception Date | January 14, 2022 |

| Total value of the Fund (millions) | $90.72 (as of [[REPORT.DATE]]) |

| Distributions | Annually, December |

| Management Expense Ratio (MER)1 | [[MER.SRI]] |

Socially Responsible Investing Criteria

With input from our Clients, we designed these Portfolios to align with investors’ values. The result is a different way to invest that avoids companies based on the criteria below.

Controversial business activities: Companies that are perceived to be generating a material level of revenue from controversial business activities, such as fossil fuels, tobacco and more.

Carbon intensity: Companies ranking in the top 25% of their sector for the most carbon intense (CO2/Revenue) manufacturing practices are removed from the Portfolio.

Established norms: Companies with alleged or verified non-compliance with established international norms (e.g. anti-corruption plus human, labour & environmental rights).

Gender representation: Companies with no female representation in key decision-making positions are also eliminated.

Controversial weapons: Companies with verified ongoing involvement in controversial weapons.

These exclusions mean that your investment in certain industries, such as energy for example, won't be as extensive as with our Global ETF Portfolios. You’ll pay a little bit more for a Portfolio that is managed to avoid companies involved in these categories. Because of these differences, the Socially Responsible Global Portfolios may perform differently than the Global ETF Portfolios. For full details, please see the Prospectus.

Want to speak to an Investment Funds Advisor?

Our licenced Advisors are here for you if you need them. Speak with us at 1-877-464-5678. Monday to Friday, 8 am – 8 pm ET.

Take a look at our other Portfolios

Core Portfolios

Tried, tested and true, these are our original Portfolios. They come with our history of helping Canadians reach their financial goals.

Global ETF Portfolios

A simple low-cost* way to have exposure to a selection of Exchange Traded Funds (ETFs) in a mutual fund.